April 26, 2015

April 26, 2015

In my experience, entrepreneurial venture is not an overnight success, they are filled with mistakes and mishaps, continually probably. No matter how great your streetwise, bookwise or intuition in the business, you are bound to face problems and setbacks along the journey. No doubt, this is the journey into entrepreneurship, it is the name of the game.

From what I have observed, many startup businesses and SMEs fail within just years, often ensued from a severe lack of business planning and implementation. What’s worse, there are various inevitable financial pitfalls that startups should have avoided in order to remain sustainable. Make no mistakes, you can improve your business performance by learning my experience shared here about the top five mistakes that kill startups and SMEs.

Mistake #1: Forcing a Business that isn’t Working

Ask yourself if you quit your job just because you have a brilliant idea that you believe will work or you intend to imitate a business idea because you see someone succeeds? Being gutsy in your entrepreneurial approach for profit and purpose is good, but you should rethink about your “supply” to meet the market “demand”, ask yourself if you have perfectly predicted the way people would use your product? What about the “feasible scale” of your product? Do you know that different forms of start-ups grow at different rates? A wiser approach is not to quit your job provided you have accurately tested such business feasibility, and there is still a reasonable opportunity it will work.

Mistake #2: Spending Too Much at the Beginning

From what I observed, many startups and SMEs spend too much money in setting up office, furniture, machines and equipment, hiring too many employees etc. without any financial considerations such as Sales per-square-feet (SPSF), payback period, return on investment (ROI), return on marketing investment (ROMI) and many others. Look, if you spend too much money on fixed cost, the expected regular commitment on fixed cost will kill your cash flow particularly when the sales drop.

Mistake #3: Starting Business with Large Loans

Nowadays many startup owners make the same old mistake of “obtaining” large amount of money from (1) family, (2) credit cards and (3) banks to fund their businesses. Look, you will feel pressure to achieve your business break-even point (BEP) – the point at where your gains equal losses, when you have to meet high monthly commitments not only to your fixed costs but also loan repayments. A wiser approach is to have low capital expenditure (CAPEX), and rely on your own savings when you begin your business.

Mistake #4: Not Hiring the Right People

Though it depends largely on the job function itself, however, I still believe that “Hire for passion first, experience second, and credentials third” is right (my personal opinion). Time is the essence of war, Sun Tzu taught – thus hiring for a startup is expensive, it is extreme different than hiring for a large corporation. In fact, when it comes to hiring employees for your startup, you will need more than a dozen of passion to get things done because startup environments are unpredictable, and only the long working hours can test the most dedicated employees.

Mistake #5: Not Having a Business Plan

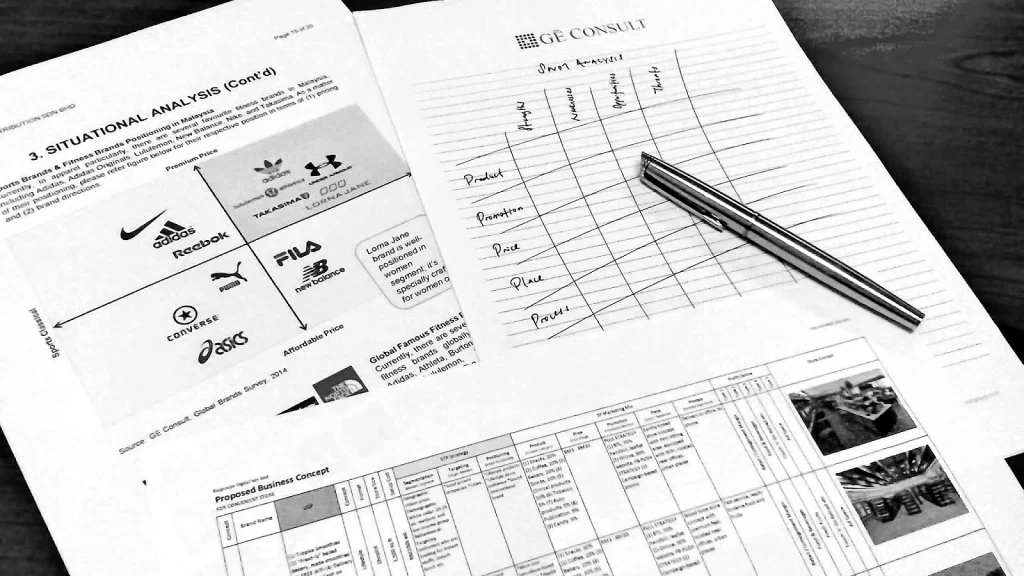

Business plan is indeed a very misunderstood document in Malaysia and the rest of Asian regions, I observed. There are good plenty of reasons for having a business plan. In fact, business plan can be very useful even if you are not applying bank loans or seeking funding from angel investors. A good business plan works well for internal management review and control, it is a life business document which starts with great vision supported by identified business objectives, useful metrics, follow-up functions and review schedules. A wiser approach is to come up with at least a simple outlined business plan equipped with business directions, objectives and financial forecast to see if your business can generate sufficient revenue and profits within a given period. Look, your business plan must include a business direction, business objectives, strategy and control, financial assumptions, break-even analysis, profit-and-loss forecast, and cash flow analysis.